Budget History

If you're hoping for a big reveal, I'm going to disappoint you, but read on anyway. Even if a little uneventful, this is the kind of analysis I'd love to see from the village. You can see some of it in the annual budget documents, but there's always a lack of candor in those documents that can downplay negative news.

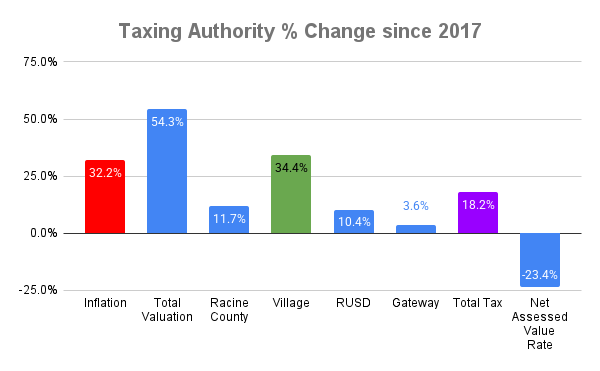

Everyone's perspective on what's happening with government finances starts with their tax bill. So I'll use my own as that starting point for this analysis. I took bills from 2017 through 2025 and calculated the percentage increase in each of the taxing authorities -- county, village, RUSD, and Gateway -- comparing the increases to the rate of inflation over that same time period.

All of us have the impression that our tax bills keep going up and the spending must be out of control, but numbers don't lie so let's assess the reality. Cumulative inflation over the same time period (in red) was 32.2%. My total valuation rose 54%, yay for me on real estate value, but total tax bill only rose 18%. Gateway (3.6%), RUSD (10.4%), and Racine County (11.4%) are well under inflation. The Village is slightly above at 34.4%. I wouldn't call that a spending problem, but let's keep digging into that number to see what's happening.

But first, a word on the drop in Net Assessed Value Rate because there's good news there. Because of state caps on total tax levy, the rise in valuation doesn't automatically translate into a tax bill increase, thus the tax rate has to fall because your total tax = your valuation * your rate. If taxing authorities could raise the levy at will, you'd have people getting taxed out of their homes. It's great if the value of your home appreciates but not if it results in a massive tax increase that you can't afford. So score one for the state's micromanagement of the tax levy calculations.

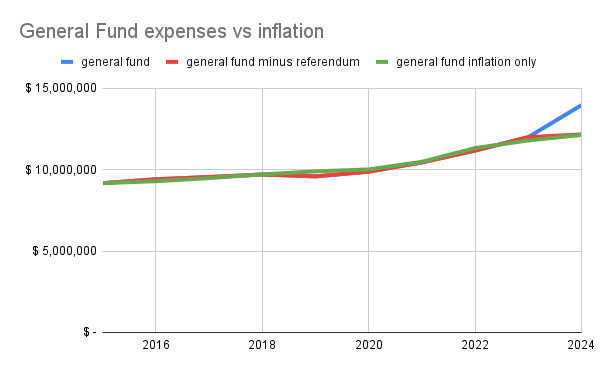

Ok, back to Village finances. I took the village's tax levy totals (minus utility districts) and plotted three lines:

Actual tax levy (blue)

Actual tax levy minus the approved police/fire referendum (red)

2017 levy adjusted each year for inflation (yellow)

I'm pretty sure the red line (levy minus referendum) dips below the inflation line because the Village was unable to spend the full $1.8M in year 1.

However, in 2024, even the referendum adjusted line rose above the inflation line.

Peeling another layer of the onion, let's look at just the General Fund, which excludes debt payments, capital improvements, and utility district spending.

Not what I expected but hey, numbers don't lie. Without the referendum, the increase is almost perfectly aligned with the inflation trend, not just over the whole timeline but year by year. The referendum of course pushes the increase above inflation, but we approved that so no complaining about an increase over inflation.

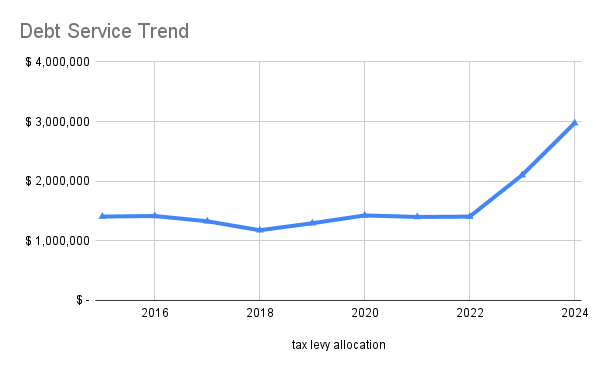

Now how about Village debt payments. This is not total debt, it's the annual payments on that total debt.

Yikes, that's a decent recent spike. Our debt payments have risen from $1.3M to $3.4M over that time period, which means our total debt has to have jumped as well. Looking at audited financial statements, Village debt appears to have risen from $56M in 2017 to $106M in 2024. If there's a detailed breakdown of debt in the financial statements I haven't found it yet, but I'll take a wild guess that the new Village Hall, Police, and Fire Station buildings are the bulk of that increase. That's not an editorial comment on the value of those expenditures, just a statement of opinion as to the source.

Recall from the Chasing Development post that total tax levy is largely the following calculation:

Last year's tax levy + % net new construction + change in debt service costs

Looking at where the increase is happening at a line item level, I believe that our Village tax bills increased a bit above inflation adjusting for the referendum because of debt service costs. The % net new construction number has been high enough every year for our general fund expenses to keep pace with inflation, no more, no less.

So what does that mean?

In my opinion, several lessons:

Like it or not, some development is needed to keep pace with inflation. A weak year or two now and again is fine, but persistent low to no net new construction would get painful after awhile, and the village's budget is largely services like police and fire. We must like those services if we voted for a $1.8M/year budget increase for them.

New development, however, needs to be steady and sustainable. Flashy big projects might produce eye-popping enticing numbers but they don't meet the steady and sustainable requirement.

We don't have a big spending problem. I'd love to blame my tax increase on a simple spending problem, but it wouldn't be fair.

Racine County, RUSD, and Gateway deserve some credit for keeping tax growth well lower than inflation since 2017. I'm not certain of the mechanics to their calculations, so maybe it's state law that constrains them, but no matter the cause, our tax bills would be much higher if those tax authorities were keeping pace with inflation.

Could or should the Village do better than inflation? I don't know. Exceeding inflation most certainly requires an explanation. If I really wanted to assess whether the Village could do better than inflation then I'd need a lot more budget detail to get a sense for which line items were inflation sensitive.

The one big issue with the budget was previously revealed in the TID 4 writeup. We'd have $1M more per year if it weren't for the $1M we were subsidizing TID 4. We could pay down debt faster or we could stunt the growth in taxes, or some of both. $1M is 5% of our $20M annual budget. That's not a trivial number.

Is there more to the story in the details of the budget? Yes, probably, there always is, but I only have publicly available documents.