TID #4

TID 4: this one is big and ugly. I'm going to do my best to stick to the numbers and avoid editorial comment. I am using only these publicly available documents and wish I had so much more to answer my myriad questions:

Village audited financial statements

Village adopted or submitted budgets

TID annual reports filed with WI-DOR

2015 TID 4 boundary change with updated financial forecast

Before I give you numbers, I'm going to lead with the counter argument I presume I would get if discussing this with someone who supported it: "This is just the way the game is played. If you're not willing to play it, then you'll never get any development in your town and you'll lose out on opportunities to grow." You can judge for yourself at the end.

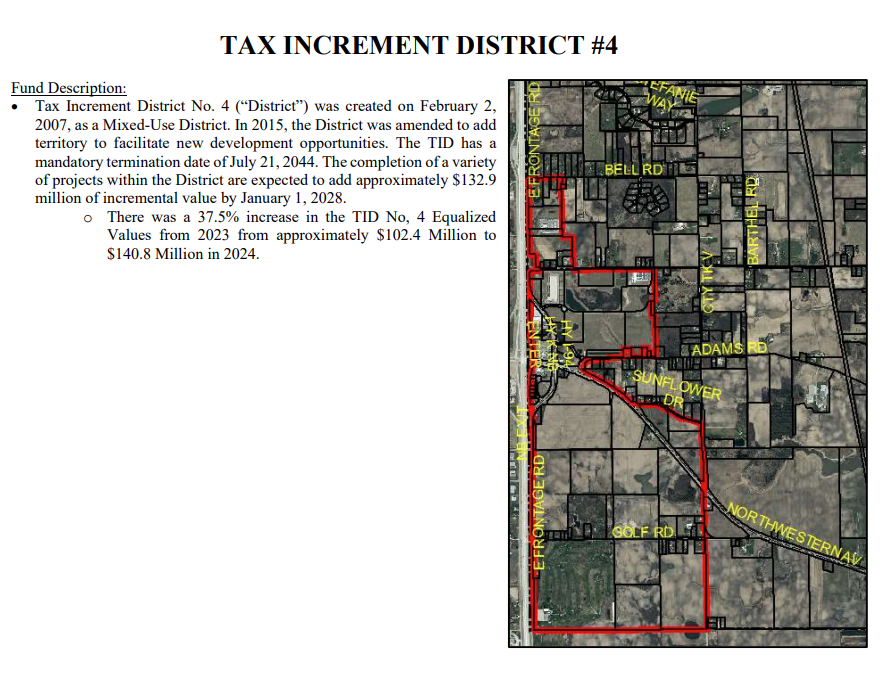

In 2015, the TID boundaries were redrawn. Land from TID 1 was moved into TID 4. When that happens, a new TID document with new financial forecasts is produced. I will use that document as a starting point for the assessment. Let's start with the state as of end of year 2024

Thus far, total project costs are $57M and total project revenues are $16.5M, leaving the TID with a "net cost recoverable" of $41M. Net cost recoverable just means the amount of money that the TID needs to collect in tax revenue before it has paid for itself. Of the $57M, $35M is capital expenditures: largely roads, water/sewer, etc. Then there's $8.7M in "developer grants/incentives." Looking through past TID filings, I can list some of the big recipients, but I can't tell why they were paid or incentivized to do what:

$3M WISPARK

$110k to CSL Centro Sperimentale Del Lattie USA

$2M to TI Investors of Caledonia LLC

>$100K RCEDC

Returning to my TID analogy from the What is a TID? post, a developer incentive is the Village giving you some money to build a slightly bigger house for yourself so the tax revenue increases. Happened to all of you, didn't it?

But let's look closer at 2024 for a bit. Big capital expenditure year of $3.2M in 2024. Big payout to developers of $2.7M. And plenty of interest on debt already incurred at $1.3M. Total $7.3M spent.

On the revenue side, tax increments were only $1.5M, then there's a line item called "Transfer In" for $1M. Total revenue $2.8M, leaving the TID losing $4.5M for the year, where "losing" means going deeper into debt. In fairness, that *can* be ok if there's just a big year of building roads or sewer pipes, but this TID started in 2007, so 17 years later to be going backwards is a little weird but I'll assume good intentions.

But what is this "Transfer in" thingee? Well, it turns out the Village is moving money every year from the general fund into TID 4.

2017: $250k

2018: $500k

2019: $750k

2020 and every year since: $1M

...for a total of $6.5M through 2024, and $8.5M through 2026 assuming the current budget gets passed.

Using the $6.5M number, that means the TID really is in the hole $47.6M not $41.1M. Why do this, you ask? Well, of course there's no explanation given in the budget doc or financial statements, but you do it to make the TID books look better. TID 4 is going backwards on net cost recoverable -- i.e. it's increasing rather than decreasing, 18 years after it started.

Now here's the important part for you so you can talk like an expert on TIDs at your next cocktail party:

If someone tries to claim that the TID will pay back the $8.5M to the General Fund, that's the equivalent of arguing that moving money from your left pocket to your right pocket makes you richer. All the money borrowed, all the money gifted to developers, all the interest and principal payments, all the "transfers in", all the general fund expenses, it's all your tax money. TIDs are just a separate set of books for related transactions so you can see whether an investment in an area is paying off *for you the taxpayer*. If you move money into the TID's books from the general fund, you're hiding that it's a crappy investment. There may be legitimate accounting reasons for doing so, but doing it minimally means the TID's initial plan isn't going well.

In case all that confused you, let me summarize: you the taxpayer are subsidizing TID 4 from the general fund $1M every year because the development in TID 4 isn't producing enough tax revenue to cover the TID's own expenses. Absent the need to do that, the general fund would have an extra million bucks every year and an extra 8.5 million over the last 10 years.

So let's close the TID 4 numbers with a comparison versus the 2015 plan.

In the 2015 forecast, the tax increment was supposed to have risen to $3.3M. At year end 2024, the actual number was $1.5M. Translated: we didn't get as much built in there as we hoped.

The total expenditures for the TID were forecasted to be $13.2 by end of 2024. Actual number: $57.7M.

Developer incentives were forecasted to be $3.5M. Actuals: $8.7M.

Total expense forecasted from 2015 to TID closure was $62M with a closure date of 2035. Consider we've spent $57.7M through 2024 and have a new closure date of 2044, it is safe to say, understating for effect:

None of that looks good.

What I'd really like to do if I had all the data is ask and answer the question: was this a good use of taxpayer dollars? Put aside the ideological question of whether granting money to developers is good or bad. Just look at pure math. We spent a bunch of money on infrastructure and other expenses, borrowed lots of money to pay for it, then some developers built some stuff, we got some tax revenue, are we on track for 20 years later better off or worse off? Did we get a good return on our money over that 20 years? This really gets at the root issue I had with the data center proposal: all revenue is not good revenue, and all development isn't necessarily good development. There are hard and soft costs to chasing revenue. And there are short-, medium-, and long-term risks. You'd better be prepared with a Plan B if those risks occur.